It was the end of March, and the Coronavirus disease (COVID-19) pandemic officially hit the United States, shutting down restaurants, schools, daycares and more. Then, many Americans rushed to their local grocery store to stock up on everything from toilet paper and hand sanitizer to frozen pizzas and frozen family meals.

The nation was preparing to hunker down for quite some time.

This “pandemic shopping” method was the beginning of the in-store grocery transformation to online—forcing many grocery retailers to implement the buy online, pick up in store (BOPIS) practice and amp up their own delivery and curbside pickup options.

“In many ways, COVID-19 created a period of ‘forced’ trial and adoption. This has been true overall, but also importantly among new demographic segments and within traditionally less popular online grocery categories,” says Carl Van Ostrand, vice president of consumer insights for DISQO. “For instance, pre-pandemic online grocery shopping was characterized by online-savvy consumers primarily buying a subset of specific grocery and CPG categories, a characterization that has been completely upended since late Q1.”

The concept of grocery delivery isn’t that new; think of milkmen delivering baskets of bottled milk to customers’ front doors. But, all it takes is a global pandemic to upend supply chains, close down cities and force consumers to adapt to new ways of doing things. And, one of those new ways involves ordering groceries online.

FMI – The Food Industry Association and Nielsen updated their predictions on online food and beverage sales to $143 billion by 2025, which will represent 30% of all omnichannel food and beverage spending. This figure was first predicted in 2017 as $100 billion by 2025 and updated last year to $100 billion reached between 2022-2024.

At the end of 2019, online grocery had already accounted for 5% of all grocery spend, according to Bain & Company.

Then, the number of consumers taking their grocery shopping online grew more than 400% in March and April of 2020 compared to 2019, according to an Escalent survey.

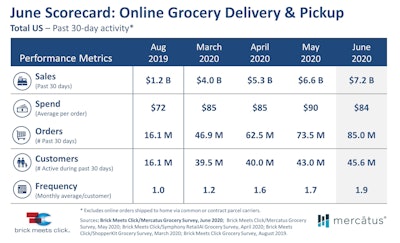

Fast forward a couple of months later, and U.S. online grocery sales reached $7.2 billion in the month of June, a 9% increase over May, as 45.6 million households continued to use delivery and pickup services, according to the Brick Meets Click/Mercatus Grocery Survey. Additionally, order frequency grew from 1.7 to 1.9 orders per month for active households. In June, U.S. online grocery sales reached $7.2 billion, a 9% increase over May, as 45.6 million households used delivery and pickup services to satisfy a larger portion of their grocery needs, according to a Brick Meets Click/Mercatus survey.Brick Meets Click

In June, U.S. online grocery sales reached $7.2 billion, a 9% increase over May, as 45.6 million households used delivery and pickup services to satisfy a larger portion of their grocery needs, according to a Brick Meets Click/Mercatus survey.Brick Meets Click

Likewise, results from an Inmar Intelligence study shows that since the onset of the pandemic, 56.7% of respondents shop for groceries online more now than compared to pre-pandemic, indicating that a strong e-commerce presence is necessary in order to see continued growth.

Of the consumers surveyed, 78.7% reported shopping online for groceries since the onset of the pandemic, a 39% increase. Nearly 51% of those surveyed preferred a grocery retailer that had the desired product type available for purchase, and 39% selected a store based on whether the grocery pick-up or delivery time was available in the preferred window.

“Execution of these online curbside and home delivery services will be paramount to seeing continued adoption post-COVID-19,” says Ken Bays, vice president of product development for Inmar Intelligence. “In June, a whopping 42% of 1,000 consumers surveyed told us that since the pandemic started, they had shopped groceries online for curbside pickup for the first time. With 100% of our respondents saying they had shopped online in some capacity in April, May and June, 44% said they see themselves continuing to buy both groceries and general retail online after the pandemic.”

Economists at Future Market Insights even say that online grocery shopping has become one of the fastest growing sectors in the U.S. retail market. The subscriptions segment, for instance, is poised to surge at a higher CAGR among purchaser type. And, personalized and smart packaging are likely to dominate the online grocery shopping scene.

These consistent growth patterns illustrate that in a post-pandemic environment, online grocery could be here to stay as many consumers prefer the convenience in having groceries delivered to their front door.

“Pre-pandemic, grocery retailers were alerted to the oncoming demand for online grocery with Amazon’s acquisition of Whole Foods, and while adoption by retailers and consumers alike made steady gains, no one was prepared for the demand the pandemic would place on online grocery and its supply chain. The dramatic increase in online grocery ordering volume exposed the food retail industry to the need for quicker adoption of modernized processes and technology to fuel efficiency and agility,” says Patty McDonald, global solution marketing director for Symphony RetailAI. “As the pandemic set in, it became evident that rapid disruption was the necessary process to support online grocery shopping as an imperative for not only convenience, but [also for] health and safety. In fact, in a survey of FMCG retailer and CPGs, Symphony RetailAI found that 89% of those surveyed believe that the events of COVID-19 are driving retailers to optimize the supply chain to support omnichannel strategies faster than anticipated.”

A McKinsey consumer survey reports that the “next normal has started to emerge,” and most categories have seen a 15-40% increase in online channel user growth.

For instance, deli meats have been high-demand items, while dairy experienced more out-of-stock in the early days of COVID-19.

“Frozen appears to be less affected especially in non-essential categories like ice cream and novelties. This is most likely due to small freezer space in most homes today. Hoarding frozen is not an option for most shoppers,” says Bays.

On the other hand, though, frozen foods have become a pandemic-proof category. A consumer survey commissioned by the American Frozen Food Institute (AFFI) and conducted by 210 Analytics LLC revealed that after a 94% surge in mid-March, overall frozen food sales held at 30-35% increases in April vs. a year ago. Nearly 86% of all consumers bought frozen food items, such as frozen pizza, vegetables and entrées since early March, and of those, 7% of consumers who previously, rarely or never purchased frozen foods pre-pandemic are now buying frozen foods.

At the beginning of U.S. lockdowns, Mercatus saw a large spike in online orders for essential items compared to the previous year, with frozen dinners raking in a 71% uptick in online orders.

“Mercatus-powered retailers saw a rapid 1,200% increase in online shopping account registrations on retailer websites and a 300% increase in retailer mobile app downloads in March, up from the previous month before lockdowns started,” says Sylvain Perrier, president and CEO of Mercatus.

Additionally, a Routific survey of 162 delivery businesses shows that 58% had started a delivery service due to COVID-19. What’s more is, 93% of those new delivery businesses said they’d continue to deliver even as the economy re-opens.

“We see a lot of big-name grocery retailers partnering up with logistics and supply chain experts to enhance the home delivery experience,” says Marc Kuo, founder and CEO for Routific. “Route optimization software has been a game changer for many online grocers and food retailers. Route optimization technology was previously only used by large corporations who had complex logistics needs and could afford a big price tag. But, there are now a number of affordable, cloud-based solutions on the market, many of which were designed for grocery and food retailers who have entered the home delivery market.”

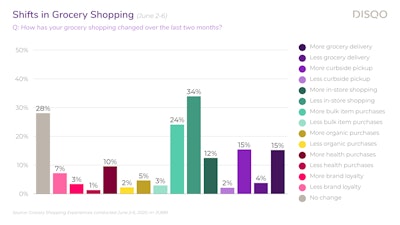

DISQO’s June Grocery Shopping Experiences survey reveals 24% of shoppers are ordering in bulk more than before. As preferred brands have sold out, consumers have tried new brands, explored more retailers and turned to bulk ordering, according to this DISQO study.DISQO

As preferred brands have sold out, consumers have tried new brands, explored more retailers and turned to bulk ordering, according to this DISQO study.DISQO

“The ‘digital shelf’ is completely different from the in-store consumer experience,” says Van Ostrand. “Brands and categories that thrived and ‘won’ in the brick-and-mortar environment will face different threats [post-pandemic].”

Some grocery retailers even turned to food delivery services such as DoorDash and Uber Eats to provide groceries and essentials to customers.

“We now have over 9,500 active merchants (97% increase since February 2020) and grocery-convenience orders have increased by over 176% since February 2020,” says Sarah Abboud, communications manager for Uber. “These figures do not include our recent integration with Cornershop, which is a huge opportunity to expand our grocery delivery offerings in the Americas.”

In February, Rosie and DoorDash partnered to bring another delivery option to independent grocers and their communities across the United States.

“Rosie saw consistent growth pre-COVID-19, but we began to experience exponential adoption once COVID-19 started influencing shopper behavior. Before, shoppers focused entirely on convenience and price. Now it’s all about health and safety. First-time users are relying on online grocery shopping to protect their families,” says Nick Nickitas, founder and CEO for Rosie.”

“Rosie saw independent retailer sign-ups increase 900% during the pandemic (Q2 of 2020) vs. pre-COVID-19. The data suggests that shoppers are adopting online as a part of their daily routine, with a 270% increase in new users and a 184% increase in revenue. Some of our retailers have experienced as much as a 40% increase in their average online basket size (year-over-year July 2019 to July 2020),” adds Nickitas. “We project that as much as half of the new online shoppers will continue to utilize e-commerce post-COVID-19. We see online shopping in the independent grocery segment growing from 1-3% of in-store sales pre-COVID to 4-15% after the pandemic is over. Currently, we’re seeing stores where Rosie is 22% of sales or higher.” All technology platforms (website, loyalty, ecommerce, point-of-sale, payment processing) need to “talk” to each other.Rosie

All technology platforms (website, loyalty, ecommerce, point-of-sale, payment processing) need to “talk” to each other.Rosie

Nickitas credits this increase to shoppers’ commitment to buying from local stores.

“From a retail technology perspective, one trend we’re seeing is the need for seamless integration across platforms. All technology platforms (website, loyalty, e-commerce, point-of-sale, payment processing) should be able to ‘talk’ to each other. Our platform enables critical expense reductions for the retailer such as cashierless checkout and low-cost credit card processing. Additionally, we were one of the first companies approved to include processing of EBT SNAP benefits for online food purchases,” he adds.

Micro-fulfillment makes its mark

One trend leading the way for online grocers is retailer expansion into multi-channel fulfillment.

“Micro-fulfillment is showing itself as a specific section of a grocery store or a small, dedicated fulfillment center meant to allow for order picking rather than ‘hunt and peck shopping,’” says Don White, North America CEO for SnapFulfil. “For this, the traditional point-of-sale model is less efficient, and therefore advanced, cloud-based warehouse management systems will become a focus. Additionally, those micro-fulfillment centers may contain limited automation to allow for more efficient operations and lower headcount.”

The BOPIS concept has also paved the way for more grocery retailers to invest in micro-fulfillment centers.

“We are now seeing models of [BOPIS] occurring regionally vs. locally with regional hub stores, dark stores or micro-fulfilment centers. This regional model offers greater picking efficiencies, but orders now need to get transported to the local level, which changes the type of packaging and equipment needed for streamlined operations,” says Andrea Nottestad, senior product manager for ORBIS Corp.

ORBIS’ mobile ORBIS Pally has the potential to support picking, delivery, staging and curbside fulfillment in one single base or platform. This mobile pallet can work within the store or from micro-fulfillment center to the store.

“Having a base like this, that can evolve as the supply chain evolves, adds value as it doesn’t require the customer to completely re-set their operations as they make changes through continuous improvement,” says Nottestad. “Additionally, as in-store picking and fulfillment continue to increase, integrated tote and cart systems offer retail associates a space-friendly mobile system to efficiently pick and fulfill orders for curbside pickup.”

For its part, Mercatus announced Mercatus Enhanced Fulfillment, a white-labeled, retailer-owned experience available to Mercatus-equipped grocers. The solution combines ShopperKit’s fulfillment technology and Radius Networks’ advanced location-based communications capabilities to offer online shopping, fulfillment and curbside pickup options.

“With Mercatus Enhanced Fulfillment, online orders made through the Mercatus platform are automatically sorted by ShopperKit into optimized preparation times and wave and zone pick paths. As employees pick and pack orders, they can connect with customers in real time for order substitutions and upsells. With real-time visibility into customer location from Radius Networks’ FlyBuy Pickup, employees can accurately track customer ETA for a seamless pickup experience,” says Perrier. “Mercatus Enhanced Fulfillment gives grocers the ability to meet growing demand for curbside pickup on their terms, while offering essential shopping services, increasing profit margin and the ability to scale their business for long-term growth. Grocers benefit by extending their brand experience beyond the store and meeting shoppers’ needs with increased time slot availability, real-time two-way communication, contact-free pickup and delivery and record low wait times at pickup.”

Another automation technology hitting e-grocery fulfillment is Swisslog’s AutoStore, a compact, robot-based automated storage and retrieval system that supports goods-to-person or goods-to-robot picking.

“The dilemma many grocers face is determining the right distribution model for their grocery chain. E-grocery orders are more complex than general e-commerce, which averages 1-2 items per order. The typical grocery order contains dozens of items and may include non-perishables, packaged chilled and frozen foods and fresh produce and meats,” says Colman Roche, vice president of retail and e-commerce sales for Swisslog Logistics Automation, Americas. “Managing fulfillment across those multiple product types requires automation technology that enables coordination across automated and manual picking processes. But, how does automation fit into their existing infrastructure? Should it be integrated at the store level, set up as a separate operation serving multiple stores or designed as a hybrid of the two strategies?” Swisslog's AutoStore is a compact, robot-based automated storage and retrieval system that supports goods-to-person or goods-to-robot picking.Swisslog

Swisslog's AutoStore is a compact, robot-based automated storage and retrieval system that supports goods-to-person or goods-to-robot picking.Swisslog

Fabric also offers a robotic micro-fulfillment solution that eliminates more than 75% of in-store picking costs, leverages retailers’ most important assets and is fast and easy to deploy, says Steve Hornyak, chief commercial officer for Fabric.

“Looking toward the future, the retailers who adopt robust micro-fulfillment strategies will be the ones to succeed in this rapidly evolving, highly competitive space,” he adds. “A micro-fulfillment solution like ours can automate 80-90% of an ordinary grocery retailer’s assortment — more than any other micro-fulfillment solution. That means it can handle loose, fresh and weighted goods all in an automated fashion, and process orders from an always-up-to-date online inventory. That means there are no substitutions, no errors, and since rotation management is handled in an automated fashion, managing the quality of fresh produce and the expiration dates of refrigerated goods is easy. This level of automation creates a better customer experience by overcoming the quality issues that have always plagued in-store manual picking.”

With e-commerce sales expected to hit $1.5 trillion by 2025, this also means an increase in demand for industrial real estate to the tune of an additional 1 billion square feet, as outlined in a report from JLL.

“With online grocery adoption rising, grocers will increasingly leverage micro-fulfillment centers as merchandise facilities for extreme efficiency, especially when the transaction volumes become higher and customers want to have items delivered to their home,” says Perrier. “These dedicated locations can enhance accuracy for online picking and packing, create space to take robotic technology to the next level and allow for additional capacity and centralized route planning.”

“As a result of the influx of gig economy shoppers in stores, grocers will increasingly build these e-commerce warehouses to avoid overcrowding the store and optimize product arrangement for online order fulfillment,” she adds. “The warehouses will need a dedicated cold storage section to keep refrigerated and frozen foods, as grocers utilize these off-site centers to prepare for the future of online grocery shopping.”  The single biggest technological innovation to happen to grocery is the automated fulfillment of online orders.Fabric

The single biggest technological innovation to happen to grocery is the automated fulfillment of online orders.Fabric

The biggest challenge many grocers face is simply keeping up with demand.

“With many restaurants still closed, consumers continue to eat meals at home. Grocers are rapidly running through fresh product, leading them to work with vendors to refill inventory quicker than they did prior to COVID-19. Many large grocery retailers have staffed drivers to route regional shuttle runs every day. Lots of these drivers are using power-only equipment to pull large grocery retailers’ trailers from store to store in order to keep up with demand. This has caused a significant increase in spot shipments,” says Tom Barry, senior manager, carrier sales for Coyote Logistics. “Every day, we have more grocery retailers reaching out to our reps looking for additional drivers to restock their inventory. As a result of this increase in demand for capacity, the shipping costs on many products have increased. Until the country re-opens fully, we anticipate this trend will continue.”

Another challenge is “cost to fulfill” and its financial ramifications in last-mile food delivery.

“When refrigerated or frozen items are ordered, this entire process must take the cold chain into consideration,” says Guy Bloch, chief executive officer for Bringg. “I predict we will see the continued evolution of both fulfillment models. Grocers that maintain a larger store footprint typically see higher cart values and will continue to invest in automated temperature-controlled solutions for both [micro-fulfillment centers] and delivery. Most of these orders will likely be planned by the shopper well in advance, and shoppers will be willing to wait a few hours or even a day or two for these orders, which provides the grocer with enough bandwidth to deliver from a CFC (a centralized MFC) with temperature-controlled transportation. Grocers that typically maintain a smaller store footprint and offer more of a ‘top up’ shopping experience will likely continue to invest in the technology to scale faster, providing on-demand fulfillment and delivery solutions to meet their customer’s immediate needs.”

Technology takes over

When it comes to supporting online grocery, there isn’t a single part of the supply chain that’s more important than the other, says McDonald.

“Retailers must implement technology to support each stage of the online grocery supply chain, from demand forecasting to order fulfillment and store picking,” she adds. “Picking technology is particularly critical, as it’s tied closely to store labor and productivity, one of the biggest cost centers in the online grocery supply chain. Furthermore, these technologies and the processes must be connected across to create truly digital supply chain.”

Automation will only continue to expand, with grocery retailers rolling out mobile apps and ordering kiosks for various platforms, according to Keith Daniels, partner at Carl Marks Advisors.

“The largest grocery stores with proprietary technology and infrastructure have a distinct edge,” he adds. “Once COVID-19 passes, I think there may be a bit of a rebalancing, as consumers will return to brick-and-mortar stores, but the penetration is now so high that consumers are getting used to have items delivered. And, this is a good alternative for the elderly now that they have embraced the technology.”

Earlier this year, Bringg integrated Postmates into its BringgNow solution to help restaurants and grocers manage their delivery operations.

“Our SaaS platform digitizes the entire online grocery supply chain for grocers, optimizing every step of the delivery cycle, automating portions of delivery and fulfillment and orchestrating all logistics, which leads to more efficiency gains,” says Bloch. “It also provides instant visibility for organizations into their supply chains, making it easier to eliminate roadblocks and pain points that are causing supply chain lags or disruptions. Leveraging and having access to that real-time data gives grocers more control over their delivery management.”

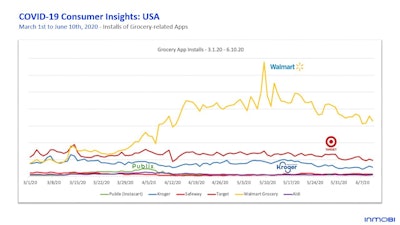

Since many of the habits established today, such as ordering groceries from the comfort of home, will become entrenched over time, this opens the door for many grocery apps to reinvent the way they do business. “Most consumers are used to browsing in-store, choosing their own products and doing it on their own schedule. COVID-19 forced change, and the urgent need for safety outweighed the barriers. Now that consumers have experienced online grocery delivery, we anticipate more will consider the option especially if they are pinched for time or face another hurdle with getting to the grocery store,” says Jeremy Huber, head of intelligence solutions for InMobi Marketing Cloud. “Since one of the contributing factors for the increase in grocery engagement is the lack of food options outside the home during COVID-19, as restaurants resume, we can anticipate that grocery purchases will decrease. As a result, we may see a bit of leveling off of grocery apps once restaurants and schools are open.” Online/digital solutions that allow for curbside or in-store pickup level the playing field, which allows brands like Walmart to lean into as an advantage.InMobi Marketing Cloud

Online/digital solutions that allow for curbside or in-store pickup level the playing field, which allows brands like Walmart to lean into as an advantage.InMobi Marketing Cloud

That’s why it’s imperative brands invest more heavily in digital retargeting to continue conversations with those users, adds Huber.

“Brands will need to market promotions, products, etc. to those who’ve adopted the apps, especially if they want to leverage deep-linking options to take consumers into the shopping experience from an ad to encourage action,” he says. “In a mobile survey InMobi ran in early June, we asked Americans what was most important for them when purchasing consumer packaged goods (which includes food and beverage grocery). [Nearly] 42% cited cleanliness, which we attribute to being related to COVID-19. However, 51% said price was a key decision driver while 41% said availability of certain items. Grocery delivery apps that are able to offer low prices and guarantee availability of certain items are more likely to keep consumers engaged and happy now and in the future.”

Bracing for the future—whatever that looks like

No one knows what the industry will look like post-COVID-19. No one really knows when the post-COVID-19 environment will even begin. Post-Coronavirus could be months into the next 1-2 years. But, one thing is certain, online grocery shopping is here to stay.

“It is an essential service element that every supermarket needs to offer to stay relevant and competitive,” says Nickitas. “The evolution of service offerings that were integrated into full-service supermarkets over time include frozen foods, self-service meats, deli departments and bakeries. Now online shopping is the department that no supermarket can lack if they want to compete as a full-service solution to the public.”

Some industry experts coin it as a new era of “Grocery 2.0,” which “will combine experiential in-store grocery shopping — food samples, cooking demonstrations, beer on tap — alongside behind-the-scenes automated e-commerce fulfillment, either in the back of the store or in an adjacent property,” says Hornyak. “Brick-and-mortar grocery shopping will never disappear —in fact, the longer we live with the pandemic and the more our lives become digital, I think people will expect even more from their trips to the grocery store. There’s nothing like smelling freshly baked bread or choosing the perfect cut of meat from the butcher. But, at the same time, we’ll all have become accustomed to the convenience of ordering our cereal, milk and paper towels online, and many of those habits will stick. That means retailers will be expected to provide a true omnichannel experience for their customers.”

Plus, COVID-19 has forced consumers of all ages and demographics to find alternative ways of accessing food.

“Grocers who already set up online shops and delivery services were able to immediately fill that demand, meanwhile other food retailers who weren’t quite ready were forced to pivot quickly or risk going out of business,” says Kuo. “The pandemic enabled online food retailers to carve a space for themselves in the mainstream, accelerating adoption amongst the masses and forcing reluctant consumers to switch from the traditional retail experience to the modern, online one. A lot of people around the globe have experienced the convenience of grocery delivery for the first time. It is very likely that the majority will continue shopping online. If you’re not ready for this new trend, it’s still not too late to get your business online.”